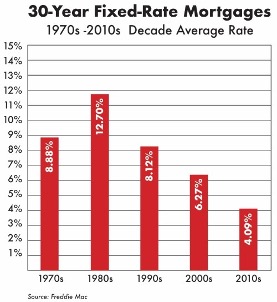

While the mortgage rate you’ll get is determined by specific factors like your credit score, historical mortgage rate trends can give you a sense of how economic conditions influence the rates available on the market today. From the 1970s to present, mortgage rates have risen and fallen, with the current 30-year fixed rate still on the low end of the scale.

Mortgage rates have fluctuated dramatically in the last 50 years of recorded data by Freddie Mac. And while rates have increased significantly this year, they still pale in comparison to the spikes in the early 1980s when the 30-year fixed rate exceeded 18%!

The good news is, even though rates have increased, they’re still worth taking advantage of. Historical data shows that the rates are still well below the average for each of the last five decades.

Although it can feel intimidating trying to purchase a home, you can prepare for increased interest rates and help protect your finances by:

- Keeping your prequalification letter up-to-date with your mortgage lender, making sure it reflects current rates. Break down the payment, not the rate, to understand how rates affect the monthly payment amount.

- Evaluating the entire payment including taxes and insurance.

- Knowing that credit score and down payment do affect rate, look at different down payment options and understand your credit.

- Ask your lender for options that fit your particular situation, you may be surprised!

Talk with a local First Mid mortgage lender today!

Sources: bankrate.com; forbesadvisor.com; Rockford Area Realtors; freddiemac.com